Option Model

Advertisement

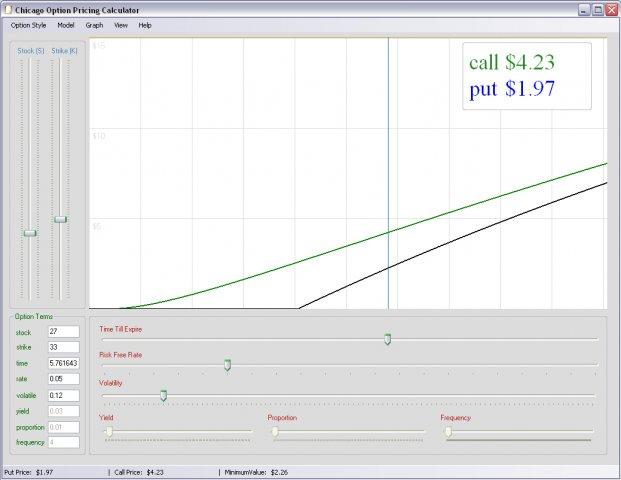

Chicago Option Pricing Model v.1.0

A graphing calculator implementation of the Black-Scholes Option Pricing Model, with extensions for both American Style Options and Extreme Value Theory.

Advertisement

Real Option Valuation

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios. Traditional discounted cash flow investment analysis will only accept an

XY Model v.1.0

Planar ferromagnet simulation. The STP XY Model software implements a Monte Carlo simulation of the planar ferromagnet or XY Model of spins on a lattice. The simulation returns the configuration of spins with the option of showing the vortices.

Option Calculator v.2.1.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

Option Calculator P v.2.0.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

Prime Option

Prime Option is used to measure what is important and to select the best option. It can be used to choose products, software, development options, shares, funds, staff, features and design points. It can also be used to measure judgments,

Scotts Model Railroad Screensaver

Scott's Model Railroad Screensaver (SBRail) displays an animated model railroad train that cruises across your desktop. The screensaver includes awesome graphical backgrounds taken from photographs of arizona. The cars are photographed verisons of actual

Option Pricing Calculator

This free option pricing calculator can be used to calculate: Call Price, Put Price, Gamma, Delta, Theta, Vega, Implied Volatility. Calculator can use three option pricing models to caculate prices: Black-Scholes Option price, Binomial American option

Option Profit Calculator

Easily compare stock or option transactions for various time periods and various investments. Input transaction information such as purchase and sale (or execution) dates, prices, etc.. Gives actual profit from the transaction and the potential loss. Also

Option Trading Workbook

Option pricing spreadsheet that calculates the theoretical price and all of the Option Greeks for European Call and Put options. The spreadsheet also allows the user to enter up to 10 option legs for option strategy combination pricing. The calculations

Queuing Model Excel

Calculate the optimum number of customer service staff to minimise your costs. Determine the number of customers waiting, average waiting time, and service staff utilization. Review the impact of changes in service point numbers on total costs. The model